Obsah článku

- 1 What Firefish can do

- 2 How Collateral Works

- 3 How Secure is Firefish?

- 4 How does Borrowing Money for Bitcoin Work?

- 5 Recovery Transaction

- 6 What if the lender does not send the money?

- 7 Instant Loan

- 8 Loan Repayment

- 9 Early Repayment of a Loan

- 10 Mini-interview with Igor Neumann

- 11 Discount on your First Loan

- 12 Conclusion

If you are somewhat familiar with the world of Bitcoin, you have probably heard of the Czech startup Firefish. I have even tried it out myself.

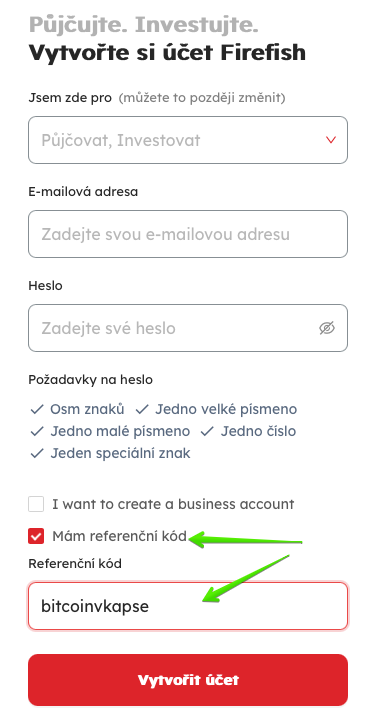

DISCOUNT: Want to try Firefish? I have a 30 % discount on the fee for your first loan. Just check the box “Do you have a referral code?” when registering and enter the code bitcoinvkapse in the field below.

Bitcoinvkapse is a Czech website about Bitcoin, and this article is a translation from the original Czech. Therefore, some screenshots are in Czech. However, Firefish speaks English, of course. The article also has a German translation.

What Firefish can do

Simply put, through Firefish, you can borrow fiat currency (dollars, euros, crowns) and put bitcoin up as collateral. This is useful when you need fiat money, have bitcoins, and don’t want to sell them. The advantages are obvious:

- You don’t have to explain anything to anyone or prove your income. You have bitcoin, which you put up as collateral, and no one cares about anything else.

- You don’t lose your bitcoin; once you repay the loan, your bitcoin is returned to you.

- If you sell bitcoin, you pay tax. However, you don’t pay any tax on the loan you receive..

If this way of borrowing against bitcoin sounds familiar and reminds you of the now – bankrupt Celsius, you’re partly right. However, there’s a crucial difference: with centralized services like Celsius, you had to send your bitcoin to a third party and gave up control over your assets. In fact, a court case against Celsius concluded that by transferring bitcoin to their addresses, users effectively relinquished ownership and had no further claim to it.

Firefish, on the other hand, never takes possession of your bitcoins. You don’t send your coins to their addresses; instead, you lock them in a smart contract—a process we’ll explain in more detail below. Firefish acts as a marketplace, connecting people who want to borrow with those who want to lend. It also provides the technology that securely locks up the bitcoin, making the loan safe for both parties—the borrower and the lender.

Firefish can also provide the opposite service, i.e., you can lend fiat money to someone and they will pay you interest in return. It is similar to what Zonky P2P platform does for investors. In this article, however, I am testing borrowing with bitcoin. I am not planning an article for fiat investors at this time.

How Collateral Works

You are probably familiar with this principle from mortgages – if you want to borrow money to buy a house, you have to mortgage the house to the bank. This provides security for the bank, and if you fail to repay the mortgage, the bank will take possession of the house, sell it, and thus recover the money it lent you. Pledging bitcoin solves the same problem, only it is much easier than pledging real estate.

Kde koupit bitcoin?

Zkuste zdejší směnárnu ⭐️⭐️⭐️⭐️⭐️️

Bez registrace a rovnou do vaší peněženky. Podívám se.

Yes, but the bitcoin exchange rate fluctuates, so how is this handled? Good question. Firefish and similar services solve this simply:

- You must pledge bitcoins worth twice the amount borrowed. This means that if you borrow $1,000, you must pledge bitcoins worth $2,000.

- If the Bitcoin exchange rate drops sharply and the price of the collateralized Bitcoin begins to approach the value of the borrowed money, Firefish will ask you to replenish the collateral—i.e., you must provide additional Bitcoin. If you fail to do so, the loan will be liquidated – meaning that your Bitcoin will be sold and the lender will get back what they lent you.

How Secure is Firefish?

The protocol, which contains details of the entire smart contract and the process of locking and unlocking bitcoins, including the tasks and activities of individual entities such as Oracles, is open source, so anyone interested can find out in detail how everything is done. However, since not everyone is a programmer (including me), I will try to describe in layman’s terms what happens to your bitcoin. I would just like to add that even if you can’t read source code, the mere fact that this option exists is a big plus. If there was a bug in the code, or even a backdoor, there is a good chance that someone would find it and publicly report it.

Firefish only acts as an intermediary between those who want to invest fiat and those who want to borrow fiat against collateral. Firefish therefore does not come into contact with either fiat money or bitcoins held as collateral. Your bitcoins are locked into a contract for the duration of the loan, which can only end in two ways:

- You repay the loan on time = the bitcoins are returned to your address

- You fail to repay the loan on time = the bitcoins are sold and the lender receives their fiat money (the third option is that the price of bitcoin falls, you fail to provide additional collateral, and the bitcoins are sold before the loan matures)

What guarantee is there that it’s all well thought out? In addition to the above-mentioned possibility of reading the code and auditing Ackee Blockchain, I also consider it a plus that many big names in the Czech and Slovak Bitcoin community publicly declare Firefish to be a great thing and support it.

How does Borrowing Money for Bitcoin Work?

After registering and logging in, you must first pass identity verification (KYC). This is something that some Firefish users criticize, but when you think about it, there is no reason to. Because you are borrowing fiat currency that is sent to your bank, you are revealing your identity anyway. So even if Firefish did not have to comply with KYC and AML regulations, you would be in the same situation. The advantage for Firefish is that it is aware of the problem and is preparing a no-KYC option where it will be possible to borrow stablecoins. As soon as this option is available, I will definitely try it out and describe it.

The identification process itself is standard. For Firefish, it is done by a third party, so you may have seen the same process somewhere else—you take a photo of your ID card, take a selfie, and you’re done.

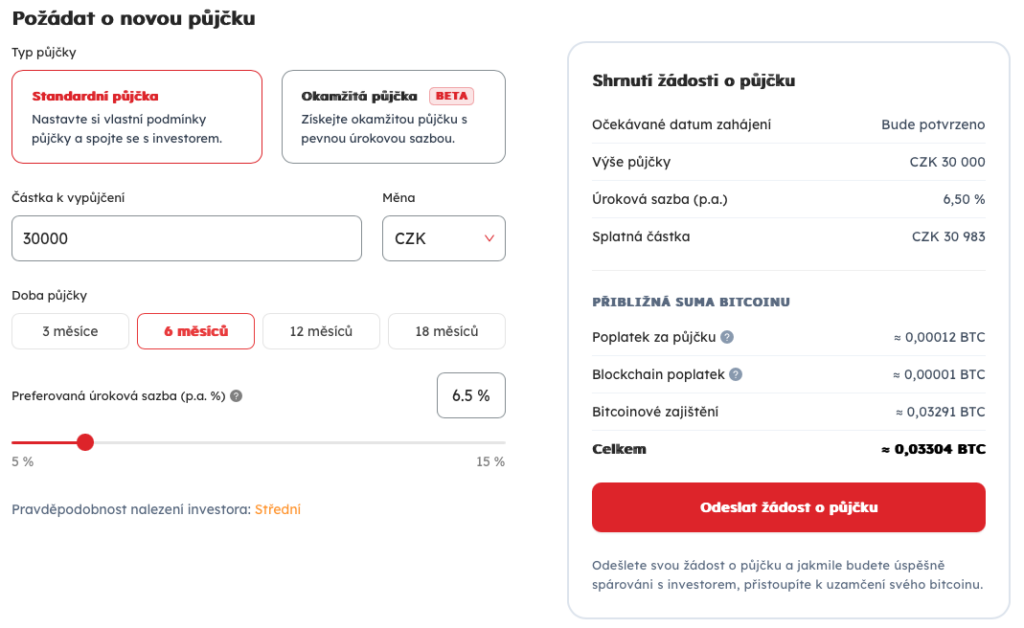

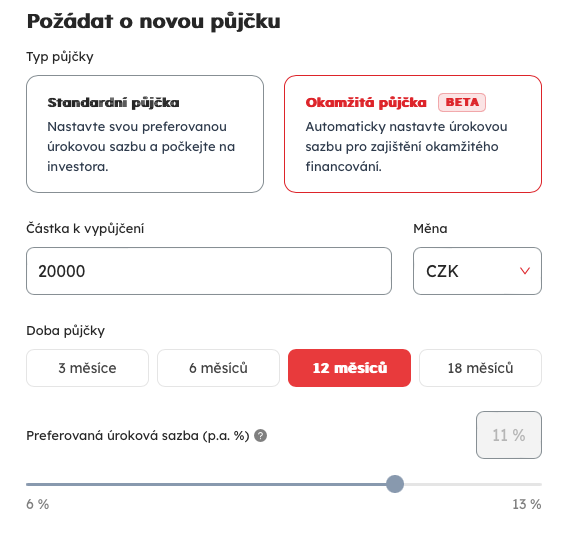

Then, on the home page, select Request a loan and fill in how much you want to borrow:

You fill in what currency you want to borrow (crowns, dollars, or euros), how much you want, for how long, and, most importantly, what interest rate you are offering. At the time of writing, based on my experience, 7 % for CZK is a certainty, but you can borrow for less if you are willing to wait for an offer.

On the right-hand side, you can immediately see how much the entire loan will cost you. In the example, we are borrowing 30,000 Czech crowns and must repay CZK 30,983 (6.5% interest) in 6 months. Other fees are already included in BTC, namely 1.5% of the borrowed amount for Firefish and a fee for sending transactions. And, of course, you can also see how much the collateral will be. In the example, you can see that we will need a total of 0.03304 bitcoin to borrow 30,000 CZK, of which the collateral, which will be returned to us after repayment, is 0.03291 BTC.

TIP: Use the promo code bitcoinvkapse when registering and you will receive a 30% discount on the Firefish fee for your first loan.

After submitting your application, you just wait for Firefish to find a counterparty, or rather, for someone to accept your offer and be willing to lend to you under the given conditions. In the overview of your applications, you will see either the status listing (waiting for a counterparty to be found) or processing (a counterparty exists, waiting for confirmation).

In the first test, an email informing me that the counterparty had accepted the offer and the loan could be finalized arrived in about two hours, but I have also experienced other loans where it took several days. I have also had a lender promise a loan and then back out. Their offer expires in 72 hours, and then you get a new one from someone else. When planning your expenses, it is better to expect that the whole process may take a few days.

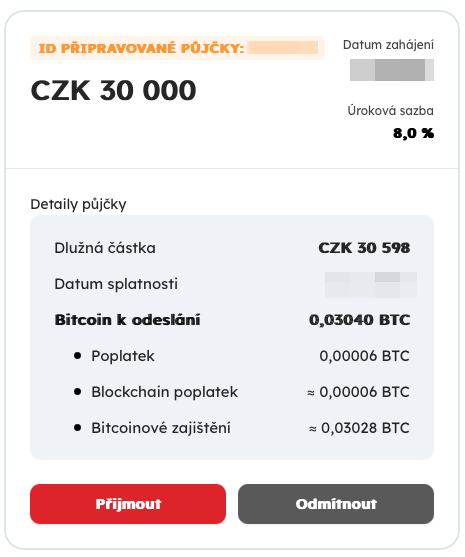

And now comes the key point. First, accept the loan. It makes no sense to refuse when someone has offered what you wanted:

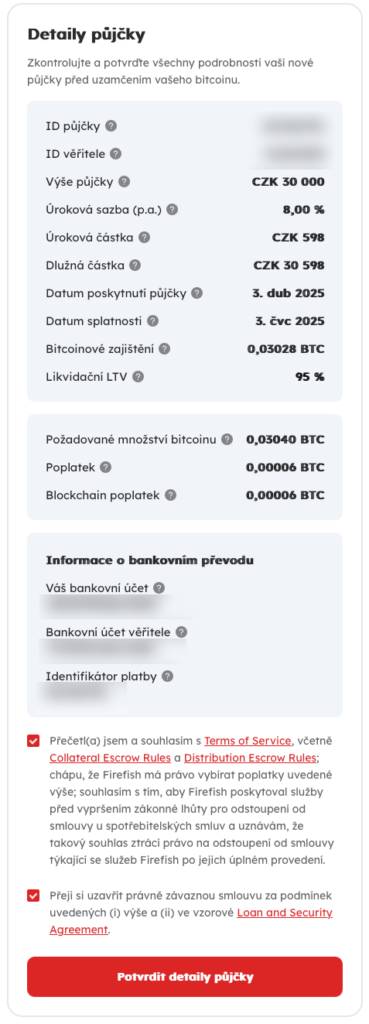

Then you must agree to the terms and conditions and all details:

Then, prepare your Trezor or other wallet and start trading with bitcoins as collateral:

- First, enter the address to which your bitcoins should be returned after the loan is repaid. Please note that this address cannot be changed, so make sure you have entered it correctly. I recommend generating a completely new address.

- Send the required amount of Bitcoin to the address generated by Firefish. I recommend using the Coincontrol function in Trezor and sending KYC Bitcoins, because you will reveal your identity with the loan. After sending the transaction, Firefish will register it within a few seconds and write to you that the Bitcoins are on their way and to wait for another email.

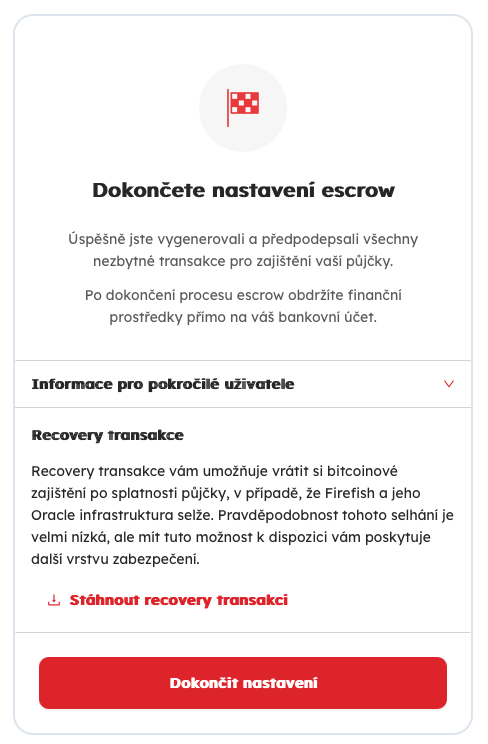

And now you can download the recovery transaction (see below)

An email confirming that the bitcoins have arrived where they were supposed to will arrive in a few hours (pay a reasonable fee!). Now all you have to do is finalize everything, which means clicking the last button to instruct the investor to send you the money. How quickly the money arrives depends on the investor and their bank. I have received it on the same day in some cases, and in two days in others. It really depends on how proactive the specific person is.

And as mentioned above, Firefish is only an intermediary, so the money will come from a specific person whose bank and name I know.

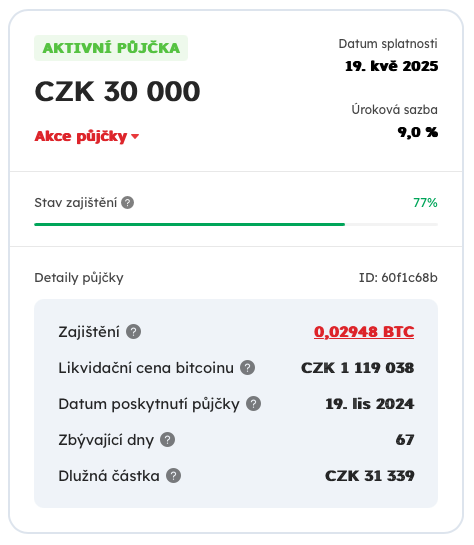

You can then see the details of the loan on your dashboard. The most important things are the number of days until repayment, then the collateral health and liquidation price. If Bitcoin starts to fall significantly, you need to keep an eye on it and add more Bitcoin to the collateral in time so that the collateral is not liquidated. However, you don’t have to monitor the Bitcoin exchange rate every day, because if this problem arises, Firefish will send you an email in time (I hope I won’t have to test this in practice :).

Recovery Transaction

During the process of creating a deposit, you can also download a so-called recovery transaction. If some crazy disaster happened and Firefish disappeared from the world along with everything around it, you can broadcast this transaction one month after the end of the contract and your bitcoins will be returned to you. If you don’t download it when creating the loan, you can do so later in the loan details.

I thought using a recovery transaction was rocket science, but the opposite is true. You can send the transaction for mining via mempool.space, for example – just copy it there and submit the form.

What if the lender does not send the money?

I’ve tried this too, involuntarily, of course. I sent collateral for one loan, waited for the money, and nothing happened. After two days, I received an email from Firefish saying that the loan had been canceled because the lender had not sent the money on time and that my collateral would be returned to me “ASAP.” Which it was, and my Bitcoin was returned to me. However, there are certain negatives, for which Firefish is obviously not to blame:

- No one can refund the transaction fees, or rather, Firefish will refund them to you, which in this case takes responsibility for them – great. Then you could probably claim them back from the lender who didn’t keep their word, but that would probably be complicated.

- You lose time, which is especially unpleasant when you are counting on the loan and are limited by a deadline. In general, I do not recommend betting on the loan arriving the next day. As you can see, anything can go wrong.

And what about the untrustworthy borrower? Firefish will ban them and they won’t be able to borrow anymore.

Instant Loan

If you don’t want to wait for an investor to be found, from November 2024 you can also take advantage of the instant loan option, where you are guaranteed to receive the money by the next day. The whole process is the same, except that the money is prepared (contracted) in advance by Firefish, so everything is faster. However, you will pay a little extra for this option in the form of higher interest rates.

Loan Repayment

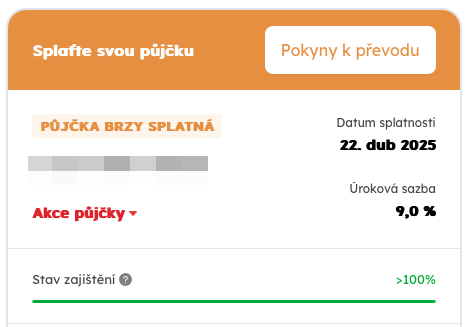

You can see when your loan is due on your dashboard after logging into Firefish, and you will also receive an email 14 and 7 days before the repayment date reminding you to repay the loan.

You don’t have to wait until the last day of the repayment period. As soon as you receive the email or the loan status changes to Repay your loan, you can repay the loan. You will find out who to pay and how by clicking on the repayment instructions (Transfer instructions). When you click on the instructions, you will find out everything you need to repay the debt: the amount, account number and lender’s name (you already know this information from the contract, so it’s nothing new) and, most importantly, the loan identifier (Payment Identifier), which you must write in the message for the recipient (it cannot be entered in the variable symbol, as there are letters there).

You will also see the Bitcoin address to which the pledged Bitcoins will be returned in the instructions. Logically, however, nothing can be done with this address, as it is permanently recorded in the contract from the creation of the loan at the beginning and is provided here purely for information purposes and so that you can check whether the Bitcoins have been returned – just look in the mempool, you don’t need to connect Trezor.

After sending the amount to the lender’s account, just check that you have sent the money according to the instructions and send everything by clicking Confirm bank transfer. The loan status will then change to Confirming your repayment, and you have to wait for the lender’s response. How long it takes depends on your banks and the lender, when they register that the money has arrived and confirm it in Firefish.

Again, it depends on the other party, and sometimes it takes a few hours, other times days. You will then receive another email stating that the loan has been settled and its status in the overview will change to Loan closed. The email also states that the pledged bitcoins will be returned within 72 hours.

I asked Igor Neumann from Firefish directly why there is a 72-hour period:

As for the 48-hour interval for BTC returns, the main reason is manual interaction, due to security and transaction fee increases (fee bump). From a security standpoint, we don’t want the Price Oracle that signs the repayment transaction to be online 24/7 without any supervision from someone on the team. Signing transactions is an extremely sensitive process, which is why we have not automated it.

And in terms of fees, a minimum fee is preset for repayment transactions when the contract is created, which in the vast majority of cases is not enough to complete the transaction. Therefore, after these transactions are broadcast, we perform a manual fee bump based on the current situation with fees on the network.

Since we do not know exactly when the investor will confirm the return of the investment, we have set a time frame of 72 hours, but based on our experience so far, the process actually takes only a few minutes, or a few hours at most.

For me, repaying the loan is even easier than taking it out. There’s no need to handle bitcoins – just make a bank transfer and the rest happens automatically. The only adrenaline rush comes from wondering whether you entered the correct address for the collateral to be returned to 🙂

Early Repayment of a Loan

You can also repay the loan early – simply send a request to the lender and, if they agree, you can repay the loan as described above.

Of course, you will pay the full agreed interest, and the lender’s consent is only necessary so that they are aware of the situation and can confirm that you have returned the money. Taking advantage of this option can pay off when the price of Bitcoin skyrockets and you have locked up too much collateral that you want to use for other purposes. Example: in June 2023, you could borrow about $1,400 for a collateral of 0.1 BTC, and a year later, $3,500. So it may make sense to repay $1,400 early and borrow $1,400 again for a significantly lower collateral.

Mini-interview with Igor Neumann

During testing, and even before that, a few things were on my mind, so I asked the most qualified person about them (I’m leaving the answers in Slovak, I believe that won’t be a problem for anyone).

Does a regular Bitcoin user who is not a programmer and is not familiar with different types of transactions, signatures, and smart contracts have a chance to verify that what you are saying is true? That is, that they really cannot lose their stored Bitcoins? Simply put, if I came and said, “Prove to me that you will not withdraw my Bitcoins and run away.”

This is, of course, a tricky question, and it is a problem with any other technology that people do not fully (or at all) understand. It’s similar to asking, “Prove to me that my internet communication is secure” when you claim that it’s encrypted, etc. In any case, we usually explain it to unsophisticated users using the following points:

- Non-custodial – a fundamental attribute of our platform is that it is non-custodial. This means that Bitcoin is not sent to Firefish or any other party. The borrower creates their address directly on the blockchain, where they send their Bitcoin. Firefish therefore has no access to users’ private keys. Similarly, the principle behind how Blockchain is created means that no one can simply change any recorded data.

- Deterministic contract – Firefish smart contracts are essentially “deterministic,” which means that once locked, Bitcoin can only be sent to two places – either to you as the Borrower upon repayment of the loan, or to the Liquidator in the event of default or liquidation due to insufficient collateral, i.e. if Bitcoin falls below a certain level (LTV 95%) and the Borrower does not replenish the collateral or repay the loan early. Bitcoin cannot be moved from escrow anywhere else, as this is technically impossible. As I mentioned, all these details and smart contract technology are available on our Document Hub.

- Escrow – The escrow address is created by the Borrower themselves within their browser (WASM). Firefish does not create this address, and the only interaction with that address (via Multi-Sig and PSBT) is that Firefish Oracles provide their keys. This is, of course, difficult to explain to a non-technical user, but it is a very important security fact.

- Open Source – The entire Firefish protocol is open source, and all details, such as what happens to your Bitcoin, where it is sent, and how, are available on our Document Hub. So it’s not a black box, but the user can find out exactly how the whole process works.

- Transparency – The escrow address is known to both the Borrower and the Investor throughout the entire process, from the moment the Borrower generates it, allowing them to track where the collateral is located and how much it is worth.

- Security Review – Our entire code and smart contract has been reviewed by the renowned blockchain security firm Ackee Blockchain.

- Track record – We have already completed quite a few deals, and the size of the locked and processed collateral is currently approaching 2000 bitcoins (~$220m USD). We will also publish this data on the platform soon.

Does the person who sent me cash only know my account number, or do they have other information as well?

The parties only know each other’s name and account number, as these are the details required for a bank transfer.

Discount on your First Loan

Would you like to try Firefish? I have a 30% discount on the fee for your first loan. Just check the box “Do you have a referral code?” when registering and enter the code bitcoinvkapse in the field below. Like this:

Conclusion

The entire process of obtaining a loan is really simple, and I didn’t encounter any problems. If you’ve ever made a Bitcoin transaction, nothing should surprise you.

Trackbacks/Pingbacks